Lethame Capital Notes

Using option theory to value value will the drawdown continue?

21st August 2020

In a fascinating series of blog posts Logica Capital Advisors¹ provide a strong argument against a narrative regarding the likely return of the value investing style as well as providing a very interesting perspective on how to think about equity market returns.

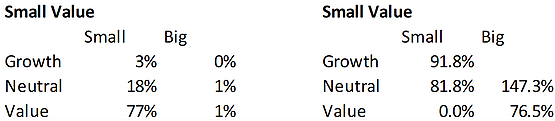

In particular they reference the conclusions of a Fama and French paper called ‘Migration’² which found that the migration of stocks across styles i.e. from value to growth, small to large etc. accounts for the majority of the returns to the size and value factors. A recent additional study by Research Affiliates³ comes to similar conclusions and shows that over the time window selected, 69% of small growth stocks stay in the small growth bucket, 23% migrate to small neutral, 4% migrate to small value and 4% migrate to large growth. By contrast 77% of small value stocks do not migrate at all.

This has important implications, a stock moves from small value to small growth just 3% of the time, however, the average return to the stock that makes this migration is 92%. The 3% frequency multiplied by the 92% return provides roughly 30% of the excess return observed by small value stocks. Important, they report that every surviving small value company that migrates has a positive return outcome.

Logica go further by noting that systematic style strategies generate their excess returns by agreeing in advance to buy or sell securities that migrate, they conclude that in effect this is economically equivalent to being short or long options respectively. By mechanistically selling migrating shares from small cap value, investors an equivalent position of being short calls to small growth, small neutral and big value. Furthermore, the purchase of shares coming out of those buckets into small cap value equates to an effective short put options against those same buckets. Having defined these styles using option theory they are then able to utilise the observed return distributions to value those options. In this process determining the theoretical return of these buckets. The results closely match the returns of Fama and French’s study.

Their conclusion is that the source of excess return from these factors is not a function of the securities themselves but is instead a function of the portfolio construction rules those strategies entail and the embedded optionality those rules create. This means the basis of the value strategies excess return is a net short volatility position.

It is interesting to consider that this portfolio construction explanation provides an interesting confirmation of the results of research by Bessembinder⁴ widely quoted in the last year or so by an extremely successful growth investor. This research concludes “the positive mean excess return for the broad stock market is driven by very large returns to a relative few stocks, not by positive excess returns to typical stocks”. Bessembinder concludes this effect was due to the “strong positive skewness to returns in individual stocks, particularly at longer time horizons”. Positive skewness, or a small number of stocks exhibiting an extremely large positive return seems consistent with the notion that value managers have manufactured a negative skewness to their return distribution through the rules they have adopted, resulting in their underperformance. In fact Bessembinder comes to the incredible conclusion that “the best performing 811 firms (1.33% of total) accounted for all net global wealth creation”.

Returning to the option terminology large cap growth managers enjoy an economic equivalent position of long call options on small growth, small value, and the big and small neutral buckets as well as long puts on big growth. In contrast to the value strategy growth managers are tacitly long volatility. What has worked in the period studied has been to buy and hold on to those stocks that are performing well, the growth style has the embedded optionality to do that and as a consequence has outperformed value.

Possibly the most interesting implication of this research is that it plays into another very significant theme noted by Logica. This is a theme which could help explain why Bessembinder has found that such a small universe of stocks have produced the majority of the market’s performance. They point to the growth of passive investment strategies, which now account for greater than 100% of equity market flows. This passive flow has significantly altered market micro-structure in a way that causes them significant concerns. Pederson⁵ notes “If active management is doomed in aggregate, then so is our market-based financial system because we need someone to make prices informative”.

Logica argue that the unprecedented outperformance of growth over value since 2007 can be explained largely by this passive phenomenon and furthermore observe the markets capacity to absorb non-passive flow has been detrimentally impacted. It might seem counterintuitive that a strategy, value, which they report is implicitly short volatility has performed so poorly in the recent environment which many would observe as having been a low volatility environment. They link this to another recent phenomenon the suppression of market volatility by option overwriting strategies. These overwriting strategies have been widely adopted by both institutional and retail investors particularly since 2008, Systematic volatility selling on the scale that has been seen has had a significant dampening effect on market volatility. Importantly, their research shows that below the surface when controlling for this effect one can observe a significant rise in correlation one of the key elements of index volatility. All else being equal observed volatility would be higher but this correlation effect can still be seen in the underperformance of the value strategy.

Finally, there is the implication that the market is increasingly vulnerable because of the dominance of the price insensitive passive flow. This dominance will make the market vulnerable to increased non-passive activity such as was seen in the COVID related sell-off. Markets should be subject to greater and greater volatility because of the dominance of increasing passive flow. It is very possible given that this flow looks set to continue that the underperformance of the value strategy with its embedded short volatility exposure has some way to go.

¹ https://www.logicafunds.com/

² Fama, E.F., and French, K.R., (2007) “Migration” CRSP Working Paper No. 614

³ Arnott, R.D., and Harvey, C.R. and Kalesnik, V. and Linnainmaa, J.T., (2020) “Reports of Value’s Death May Be Greatly Exaggerated” Research Associates

⁴ Bessembinder, H., Chen, T., Choi, G. and Wei, K.C.J., (2019) “Do Global Stocks Outperform Treasury Bills” Journal of Financial Economics

⁵ Pederson, L.H. (2018) “Sharpening the Arithmetic of Active Management” Financial Analysts Journal