Strategy Update

7th April 2020

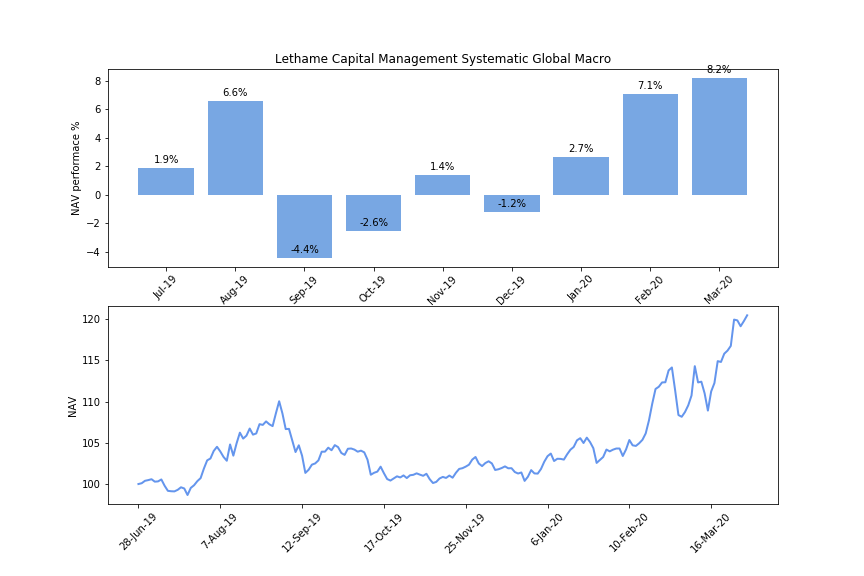

Four years ago, I started a process that I hoped would distil close to thirty years of learning about markets into a framework for managing wealth in the long term. The goal was to create a systematic investment program diversified across premia, time horizon and asset classes in a risk managed way in order to maximise the growth rate of capital. This required an exhaustive review of academic literature, extensive proprietary research and thousands of hours writing code in order to develop a systematic program that could be applied to ‘live’ markets. After 9 months of real time trading, the challenging performance of risk assets in the last month has been a significant test of what the system aimed to achieve. While recognising that any system dealing with random processes is exposed to a fair amount of chance variation, particularly in the short term, it is satisfying that in very challenging market conditions the 19% return the system has delivered in 1Q20 show that the concepts of robust risk premia, diversification and risk management can deliver returns in line with what was originally hoped.