Lethame Capital Notes

Stocks for the long run?

26th August 2020

In “Stocks for the Long Run” Jeremy Siegel¹ argues that stocks have returned an average 6.5 – 7 per cent per year for over the last 200 years. This has become known as ‘Siegel’s constant’ and is perhaps one of the most vocal arguments in favour of buy and hold investing.

In our recent post “Using option theory to value value” we highlighted Logica Capital Advisors² research on the optionality embedded in systematic factor strategies such as value. They argue that agreeing in advance to buy or sell securities that ‘migrate’ is equivalent to a long or short option position. In essence by mechanistically selling migrating shares from small cap value, investors are effectively short calls to small growth, small neutral and big value. Furthermore, the purchase of shares coming out of those buckets into small cap value equates to an effective short put options against those same buckets.

This theory could help explain why value has performed so poorly relative to growth for over a decade. When noting the dominant flow that passive investing has become and the hidden volatility that has resulted, it is clear that the embedded short volatility position of a strategy that shows an equivalent short option position would be expected to underperform. Conversely, we expect growth strategies whose effective position is long call options on those stocks which successfully migrate to outperform.

It is interesting to consider this theory in the context of arguments presented by Bessembinder³, and in particular in his 2017 research paper “Do Stocks Outperform Treasury Bills?” In this paper he made the headline grabbing assertion that “The entire gain in the US stock market since 1926 is attributable to the best four percent of listed stocks”. More specifically he noted that just 42% of stocks have a lifetime return that is greater than holding one-month treasury bills for the same period and furthermore more than half of stocks have negative returns over their lifetime.

The finding that the majority of stocks generate lifetime negative returns is difficult to reconcile with the “Stocks for the Long Run” narrative. Rational investors are presumed to be risk averse, and widely accepted models imply that a positive return premium is expected. The Capital Asset Pricing Model in assumes that a stocks expected return is equal to its beta times the market risk premium. Given that betas are almost always positive for stocks and the market risk premium is assumed to be positive each stocks expected return should also be positive. The CAPM in particular relies on the assumption that stock returns are normally distributed in which case the mean and median returns are equal.

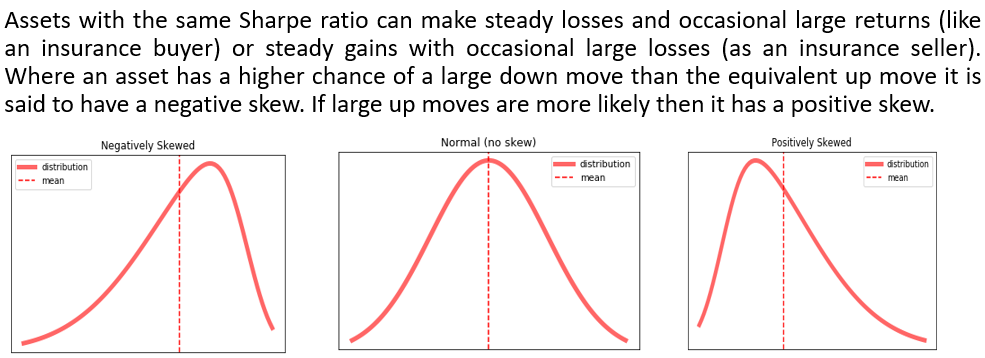

The fact that stocks mean excess return is positive and yet a majority of stocks perform worse than the treasury return is a function of stocks median excess return being negative. The idea that the median return is less than the mean comes from a positively skewed return distribution. Bessembinder presents evidence in support of the idea that single period returns are positively skewed but also shows that that is not a necessary condition for positive skewness overall. Compounding of multi-period returns can be shown to produce positive skewness. This is best illustrated by a two-period example. Consider the case where the single period stock returns are either 20% or -20% with equal probability. The distribution is symmetric about a mean of zero. The two period returns are +44% (25% probability), -4% (50% probability) and -36% (25% probability). The two-period distribution is positively skewed given that the median -4% is less than the 0% mean, and the probability of observing a negative two period return is 75%.

A positively skewed return distribution has the characteristic that a small number of stocks experience very large gains. These stocks with very large gains are most often the stocks which migrate from small to large, value to growth and on which growth investors have implied calls. Value investors on the other hand require mean reversion the ingredients for which Logica would argue have been diminished by the dominance of passive flow in equity markets.

This highlights the importance of portfolio diversification. A poorly diversified portfolio may underperform because it lacks exposure to the small number of stocks that generate large positive returns. This could help explain why active portfolio management strategies which tend to be poorly diversified, the investment management industry tries very hard to sell ‘focused’ funds, frequently underperform the indices they are trying to beat.

Positive skewness is a very attractive characteristic which very few investment strategies exhibit. Those strategies, like Lethame Capital's, which incorporate trend following generally return positively skewed distributions.

¹ Siegel, J.J., (1994) “Stocks for the Long Run” McGraw-Hill

² Bessembinder, H. (2017) “Do Stocks Outperform Treasury Bills?” Arizona State University.

³ https://logicafunds.com