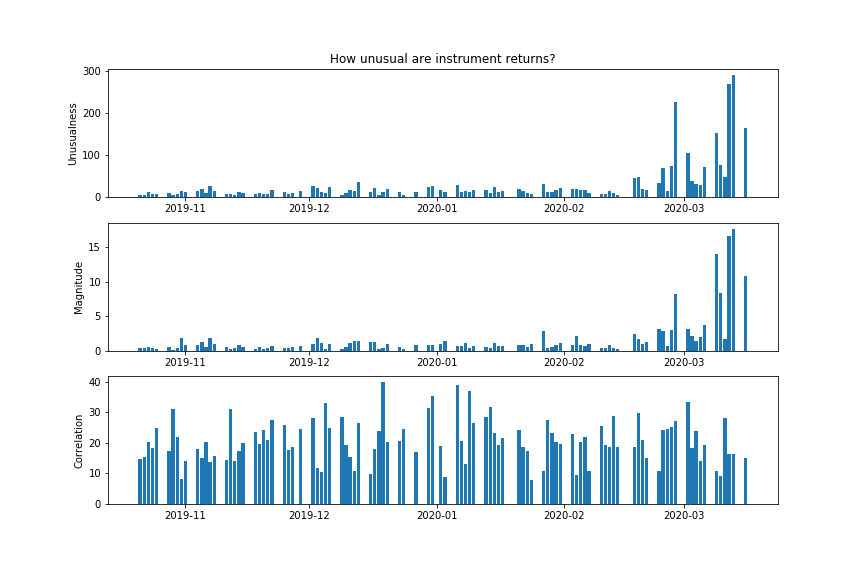

How unusual are instrument returns?

11th March 2020

Lethame Capital tracks the statistical unusualness, of the trading activity in the instruments it trades. Monday’s crude oil driven volatility was the second day in as many weeks when large price movement occurred in conjunction with unusual correlation. This level of unusualness often suggests that markets will exhibit further volatility and therefore negative price trends in risk assets could continue. Lethame Capital’s systematic investment program is designed to take advantage of these price moves and aims to provide exposure to a diversified mixture of return streams capturing different trends. However, the program is calibrated so that it scales back the risk it takes should the instruments it trades exhibit an unusually high level of co-movement indicating that markets are being driven by a single underlying trend and making the program more vulnerable to a reversal of that single trend. At present the program has not identified that markets are tightly coupled enough to warrant a reduction in the level of risk it takes and so for the moment the program continues to target its normal risk allocation.