Lethame Capital Notes

Gold futures - conspiracy theories

29th May 2020

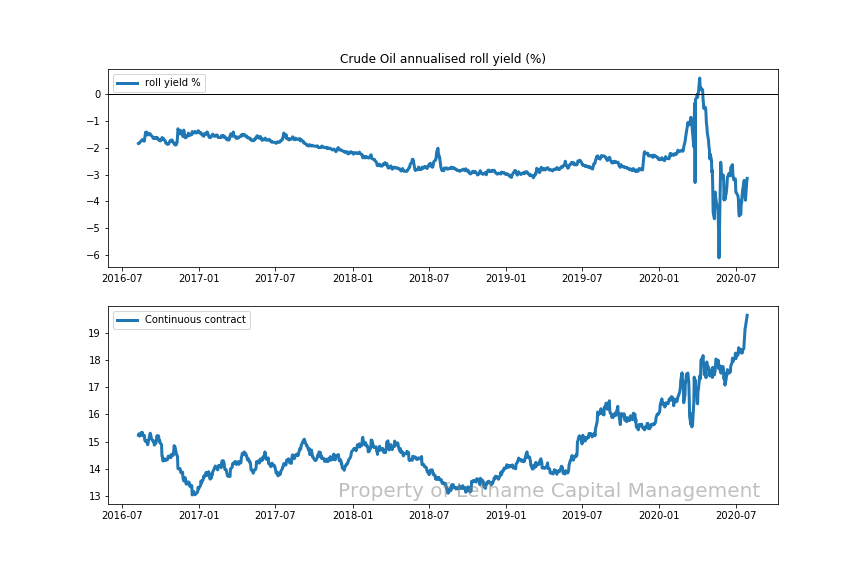

The vast majority of the time the gold futures market is contango, which is a normal condition for durable, easily storable commodities which have a carry cost. The higher prices in the future which contango represents is a way of paying these costs. A market in contango, which has this premium embedded, makes life difficult for the futures long as all else equal the futures price declines towards the spot price as the future approaches expiry. The larger the contango, the bigger the loss the long suffers on the position.

Similar to a number of other futures markets, the COVID-19 crisis created a substantial variation in the term structure of gold futures. Very unusually, for a few days in April, the market was in backwardation but has subsequently returned to significant contango. It has been suggested that the COVID crisis shutdown meant that it was very difficult to move physical gold, resulting in a shortage of the metal available to settle maturing futures contracts. Indeed there are many conspiracy theories which circulate around this subject https://www.fxstreet.com/analysis/all-is-not-well-in-the-gold-paper-markets-202004061906.

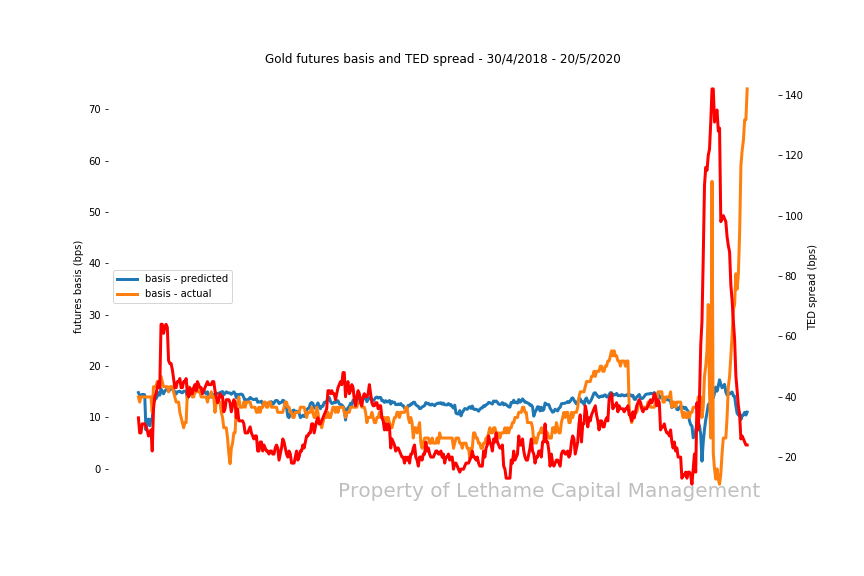

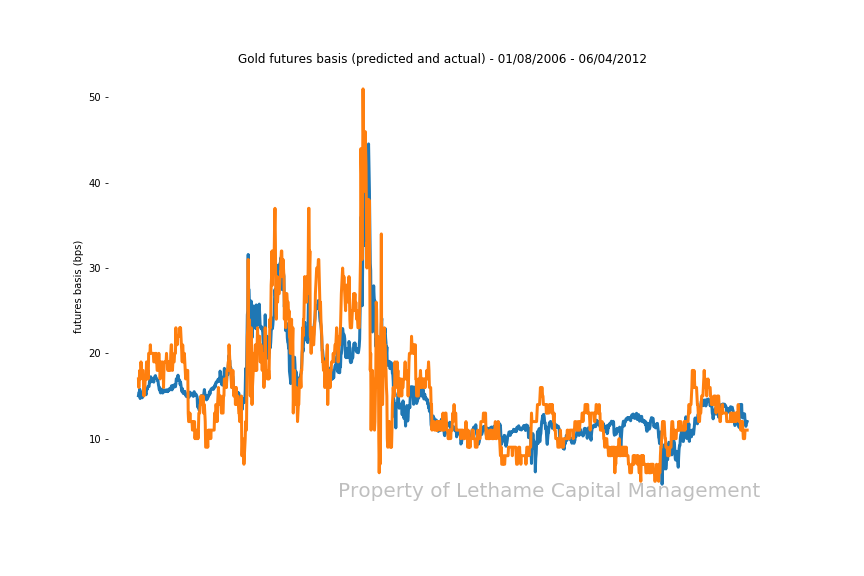

We were reminded of a 2014 paper* whose hypothesis was the cost of carry model for gold could be improved with an extra risk premium term. By incorporating the VIX Index, the realised volatility of the Goldman Sachs Commodity Index and the TED spread, the model would better capture the effect of increased volatility and in particular credit risk on the futures basis in times of heightened risk-off sentiment.

In May, we saw the gold basis move very sharply at the same time as a substantial widening in the TED spread, as extreme risk aversion dominated the early stage of the COVID crisis. Since then, however, the unprecedented stimulus provided by central banks has seen the TED spread return to more normal levels and volatility across markets has declined substantially. The gold basis on the other hand remains extremely elevated.

Out of interest we reconfigured the model to capture the percentage rather the absolute basis of the original model, including the Newey-West adjustment to the error terms. Our validation of the model on the data available at the time of the paper arrived at a broadly similar conclusion. The papers summary was that “the TED spread creates the largest variation in prices compared to the other regressors”.

In May, we saw the gold basis move very sharply at the same time as a substantial widening in the TED spread, as extreme risk aversion dominated the early stage of the COVID crisis. Since then, however, the unprecedented stimulus provided by central banks has seen the TED spread return to more normal levels and volatility across markets has declined substantially. The gold basis on the other hand remains extremely elevated.

While the financial stresses of the crisis appear so far to have been dampened by aggressive central bank action, not unlike the conspiracy theorists the gold market remains concerned about factors not captured by this model.

*Riley, Edward M. III, "The Cost-of-carry model and volatility: an analysis of gold futures contracts pricing" (2014).Honors Theses. Paper 861