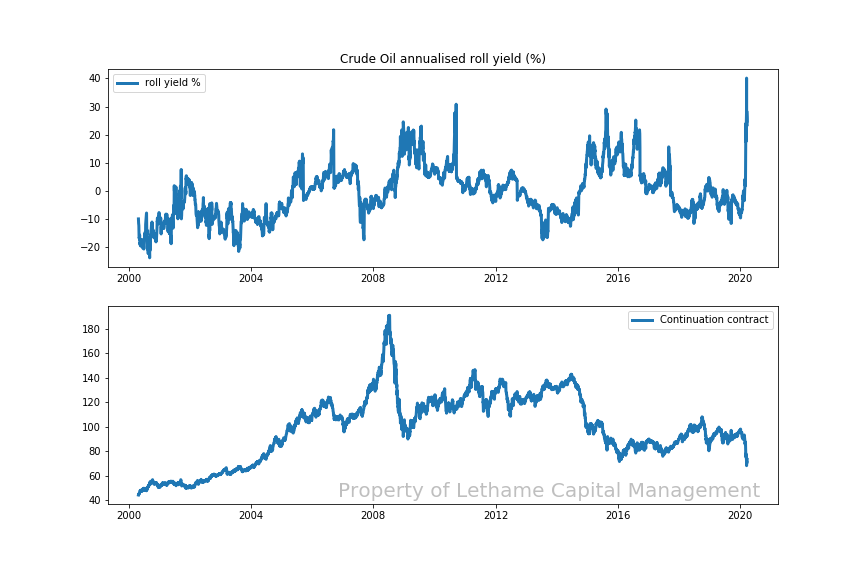

Crude oil - record contango

26th March 2020

While the headlines focused on the carnage in the spot market, COVID-19 related fears of a slump in demand combined with the supply shock of Russian refusing to join an OPEC production cut has caused the oil market to enter contango in February. Contango is consistent with the physical commodity market shifting into large surplus.

The top chart shows the annualised roll yield available area of the curve we track since 2000. The bottom chart is of the continuation contract for oil prices that our system creates. While this part of the curve has been in contango over 43% of the time over this period it is clear that the level of contango has not been seen in many years.

The futures market is doing its job. Contango means longer dated futures trade at a premium to near dated contracts and this encourages traders to keep oil in storage for a more profitable sale in the future. This means speculators are incentivised to short longer dated contracts and capture the roll yield as they move down the curve.

The process of shorting longer dated contracts and rolling means those shorting essentially become synthetic storage providers and this is a process which will help the market work through the surplus. According to research from PIMCO* “the shape of the oil curve has historically been one of the best predictors of future returns…subsequent four and 12-week returns of -1.7% and -3.5%...during contango markets”. These expected returns are consistent with the principal of speculators being rewarded for providing liquidity to hedgers.

*Johnson, N.J., and Dewitt, A., (2017) “Oil Market Shifts from Contango to Backwardation - implications for investors” PIMCO